Table of Contents

What is a Stop Out Level in Forex?

Are you wondering what stop out level in forex actually is?

If you’re interested in forex at all or have been reading about forex trading, then it’s likely you’ve come across the term stop out level.

A stop out level in forex is something that happens when a trader’s open positions are automatically closed by their forex broker.

Leverage means that the trader is trading a position with money that they do not technically have.

This thanks to the broker lending a certain amount of money that is usually much higher than the amount a trader originally has.

When a trader reaches a certain threshold and is in losing trades, they sometimes run out of free margin.

Free margin is the capital in a forex trader’s account that is available to trade with (hence why it is called ‘free’).

A stop out happens because the trader has no free margin. They simply do not have enough money to stay in a trade.

A stop out is similar to a margin call.

How to Avoid a Stop Out

Preventing a stop out is crucial when it comes to forex trading.

If you want to avoid a stop-out and the negative outcomes that come with it, it’s important to take some necessary steps.

Some general tips that might help you are:

- refraining from opening too many positions at one time. Since more orders basically mean more equity used to maintain a position, this leaves you with less free margin.

- advised to make use of stop-loss, which allows you to somewhat control or limit losses. Losing trades are just that, losing trades, so there is no excuse to keep them open and lose lots of money.

- advised to only trade with what you have. No need to get dreamy- this is where proper money management in forex comes in. It’s common knowledge that forex is highly volatile which means you can make a sizeable return on your investment fast, or you can lose a substantial amount of capital just as fast. Trade smart.

Using leverage in forex trading is an incredibly useful tool that can also be very dangerous, and have a huge impact on your capital and equity.

Remember, you absolutely do not need to use leverage at all- especially if you are unfamiliar with trading.

For this reason, it is not to be taken lightly. Avoiding a stop out in forex trading is essential, and doing so will promote the livelihood of your finances and livelihood.

How to Calculate Stop Out Level

How to Calculate Stop Out Level

Stop Out Level is simply a required margin level expressed as a percentage, at which point an open trade will be automatically exited by the broker.

The Stop Out Level is given by the broker.

Stop Out Level Calculator

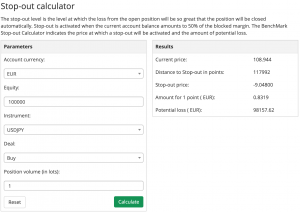

If you need help calculating stop out level or related figures, this stop out level calculator can help you.

This calculator requires the following data:

- account currency

- equity

- buy/sell

- position volume (in lots)

After inputting the above data, this calculator will output the following:

- current price

- distance to Stop-out in points

- Stop-out price

- The amount for 1 point

- Potential loss

This is a useful tool for calculating the various figures involved in stop-outs and stop out levels.

Stop Out Level Example

Let’s say you have a trading account with a forex broker, who in this case has a 20% stop out level and a 50% margin call level.

Your total balance is exactly $10,000– you open a new position with a margin of $1,000.

Let’s say your total losses reach up to $9,500, which leaves you with $500 left.

So, with $500 current equity, this means you are already at 50% of the used margin.

(Remember, the margin call level is 50% and the margin used to open the new position is 1,000. $500 equity is 50% of $1000 margin).

Because you have reached 50%, your broker issues a margin call warning.

When the total loss finally reaches $9,800, this means you have $200 in equity left ($10,000-9,800=$200).

Because your equity is now at $200, you now have 20% of the used margin.

So, because of your losses, a stop out is triggered.

In order to prevent all future losses, the broker will close the losing position.

You are left with less money than before and no hopes of regaining it in this trade.

However, you are protected from further losses (losses that could amass levels that could possibly bankrupt you, and lose your broker a lot of money due to your inability to pay it back).

Learn to Trade Forex

Learning forex terms such as ‘Stop Out’ and ‘Stop Out Level’ will help with general forex knowledge, but simply knowing definitions won’t actually help you make any real money when it comes to trading.

If you want to really learn how to make the big bucks with forex trading, you need to learn how the markets work and the proper strategy necessary in order to extract profit day in and day out.

If you are new to the forex trading world and want to learn how to consistently turn a profit, it’s important to educate yourself- one way to do this is with a course.

For those who want to join us (as in forex traders who do this for a living), check out our post on a course that will teach you how to trade forex.

Also, if you want some help, make sure to get a copy of our Free Forex Trading Fortunes PDF.

Get your copy sent straight to your email below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.

How to Calculate Stop Out Level

How to Calculate Stop Out Level