Table of Contents

What is Forex Margin?

Margin is a concept in forex that is both important yet widely understood.

Note: ‘Margin’ is a separate term from ‘free margin‘.

In this article I will not only explain exactly what forex margin is but also give you an example, since it is sometimes hard to make sense of yet is important for any trader to understand.

I will also show you how you can calculate forex margin.

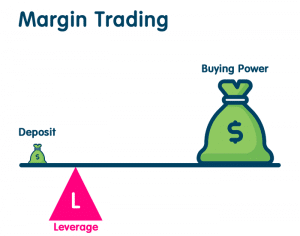

One of the reasons forex margin is misunderstood is because it is often confused with forex leverage.

Forex leverage is a the ability gifted to a trader by a broker that allows you to trade with volumes much higher than your forex account actually contains. It can range anywhere from 50 to 250 times the amount you want to risk on a trade.

Now that you know or remember what leverage is, make sure you are able to distinguish it from margin.

Margin in forex is the actual deposit required from the trader in order to use the leverage your broker provides you.

I use the word deposit because it’s the closest thing to one.

What margin is not is a transactional cost, or fee.

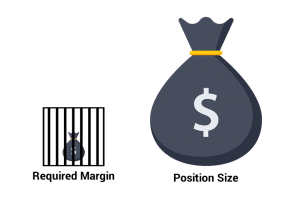

Forex margin is simply ‘collateral’ entrusted with your broker so you may open a large position, and keep it open.

Margin’s are only a small portion of your forex account as insurance.

Your broker needs this insurance to make sure you, the trader, are able to cover any cost they are fronting you while you use leverage.

Here’s an example of forex margin used with leverage.

Example of Forex Margin

Let’s say you, a forex trader, has a currency pair in mind that you believe will be favorable to you.

For the sake of this example, you hope to open a position worth $50,000.

I don’t know about you, but $50,000 is a lot of money that I certainly did not have in my forex account when I first started trading.

Luckily, your forex broker offers a leverage ration of 50:1.

With a 50:1 leverage ratio, your broker will only need to hold $1000 from your account. (If the concept of forex leverage is still foreign to you, please read my full length post about it here).

The $1000 your forex broker sets aside so that you can open the trade worth $50,000 is your margin.

Your margin is the deposit your broker requires for you to take advantage of the leverage.

The reason your broker takes a margin is so that they can then effectively ‘pool’ it with other traders margin’s, which they use themselves as a deposit so that all of their forex traders (you) can trade the forex markets.

How To Calculate Forex Margin

Forex margin is typically expressed as a percentage.

The percentage is the total amount of the trading position.

Let’s say your forex broker offers a leverage of 100:1. This would mean your broker requires a 1% margin.

If your broker offers a 50:1 leverage, this means they require a 2% margin.

This is usually expressed as vice versa.

So, if a broker’s margin requirement is 5%, the leverage allowed is 20:1.

If the broker’s margin requirement was 3%, this is 33:1 leverage.

The math is just relating a percentage as a ratio, or vice versa.

Forex Margin Calculator

If you are struggling with the math and need to calculate a forex margin, there are plenty of websites online that offer this service free of charge.

A good one that I’ve used when I’ve had trouble calculating difficult forex margins (some of them are just plain hard, such as a 3.5% margin) is from myfxbook.com.

This calculator doesn’t simply give you the exact ration from a margin percentage, but it tells you how much your margin will cost you depending on currency price, currency pair and trade size.

This is very useful if you are ready to make a trade and need to figure out how much capital you need as a margin to gain your desired leverage.

If you aren’t sure how much leverage/required margin your forex broker allows you, simply email the appropriate contacts or search their website. Usually this information is readily available to you as a client of theirs since it is always a frequently asked question by traders.

Learn to Trade Forex

Margin’s in forex is a necessary element that you are almost surely going to come across in your trading career. This is especially true as you become more experienced and need to make bigger trades that are beyond your current equity account.

Both leverage and the coinciding margin rate in forex trading are tools that allow you to make much bigger profits, however this can also be a trader’s downfall.

It is not uncommon for a beginner trader to ‘bite off more than they can chew’ and use leverage to trade with volume that is much more than they can handle.

It is suggested by most to hold off on using forex leverage until you understand how the markets work and are able to make steady profits from trading.

If you are not at this more experienced level of trading yet, that’s ok- we all start somewhere.

For the novice trader who is ready to start making a proper living off of forex, it’s important to learn how to make an income from trading everyday, not dependent on how favorable or unfavorable the markets are.

The difference from a professional forex trader to a beginner is the ability to make a profit from trading, every single day.

If you are a beginner and want to learn everything you need to know about forex trading and more, check out my post here about a course I recommend that will seriously get you as close as you need to be to those big profit trades.

And, if you haven’t already, feel free to grab our Free Forex Trading Fortunes PDF – get your copy sent straight to your email today.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.

I am now not sure where you are getting your info, however good topic.

I needs to spend some time studying more or working out more.

Thanks for excellent information I was in search

of this information for my mission.