Table of Contents

“Always use stop-loss orders.”

-W.D. Gann, legendary investor/trader

What is Stop Loss in Forex?

Stop loss in Forex is a great way to minimize the amount of money you lose through trading.e

It is an exit plan in the event of a losing trade.

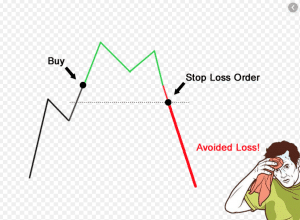

Essentially, stop loss is a limit you set to minimize your risk that automatically exits you out of a trade if your currency pait dips below a level that is losing you money.

Stop loss is a valuable mechanism that forex traders must use if they want to make a living from Forex Trading.

It is especially essential for beginner and inexperienced forex traders who aren’t able to always make the best trade choices.

Stop loss, while important for beginners, is also used by many experienced traders. There’s no downside to protecting your trades- unexpected fluctuations of currency prices happens all the time, and it’s wise to safeguard your investing when you can.

Stop loss also allows you to make trades and walk away from the computer for a while, instead of having to watch the currencies change.

It also worth mentioning that stop loss can work against you.

Let’s say your stop-loss is hit and you are automatically backed out of a trade, and after you’re exited from the trade the currency pair swings back the other way exponentially? Not only did you just lose money on the trade, you missed out on a potentially big profit. This is why some forex traders might have a disdain for stop loss since they view it as missing out on opportunities for major swings in a currency pair.

While it depends on who you talk to, the majority of forex traders will advise you to use stop loss, especially for beginners.

It’s necessary to know about stop loss orders and how to calculate the proper limit to set it at.

What Are Stop Loss Orders?

Stop loss orders are the actual ‘boundaries’ you set because it’s impossible to see the future, and sometimes it’s difficult to correctly predict the direction a currency pair is headed.

If you place a stop loss order, it is basically placing insurance on your trade. It is similar to cruise control on cars- it sets a limit on how much money you can lose, the same way cruise control prevents you from exceeding a speed limit.

It is especially helpful if you are unable to be at your computer for a period of time, or might now have access to internet.

How horrifying would it be to enter into a trade, have your wifi crash, and get back online only to see you’ve lost $300?

Exactly. This is why stop loss is so valuable, and why beginner traders must become familiar with the term.

How Does Stop Loss Work?

Stop loss works when you apply a smart strategy and stick to it for all your trades.

Once you have a strategy that you feel comfortable with, stay with it.

It’s easy to get emotional in the forex game- I myself have been a big victim in the past of doing this.

Sometimes when you enter a trade you might think you have a special feeling about this one currency pair. You might have a fantasy of winning big on this very trade and think that this is the one. For whatever reason, this trade is going to swing so high and you’re going to cash out big this time.

This is where stop loss strategy really comes into play, and why I am a huge proponent of it.

Like I mentioned earlier, lots of traders neglect stop loss orders because they feel it might be robbing them of their potential winnings when they are automatically exited out of a trade.

I can see why they might think that way. When the time comes that a stop loss you set pulls you out of a losing trade, only to then skyrocket whilst leaving you behind with less money than you had before, it’s easy to get bitter.

“Why did I set that stop loss? I just missed out on one of the best trades of the day.”

Right, this is true, you did miss out. But the key idea to remember is that in the long run, you are saving yourself lots of cash.

You’re only going to see the money that you lose on a bad trade and the money you miss out on- you’ll never know how much you might have lost if you never used stop loss in the first place. This can lead you to think negatively about setting a stop loss order since all you see the money you could have made.

Figure out your stop-loss strategy and keep to it- it will save you in the long run.

Nailing down a proper stop loss strategy before you start trading is one of the best ways you can ensure yourself from the always-changing forex market.

Best Stop Loss Strategy

It would be unfair for me to recommend the best stop loss strategy because the question is so broad.

Choosing the best stop loss strategy depends on your experience, skill level, bankroll, etc. There are so many different factors that will impact what the best stop loss strategy will be for you.

As with everything in forex, it’s best to educate yourself on forex trading strategies to eventually get to the point where you’re making a consistent income through online trading.

The fastest way to do that is with a proper forex course- you can find my personal recommendation here. It is easily the best course I’ve come across that gives you all the tools you need to start making profitable trades fast.

If you haven’t already, grab our Free Forex Trading Fortunes PDF below!

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.