Table of Contents

Money Management in Forex

A topic I don’t see covered enough is money management in forex. It seems like most websites focus on strategies and programs that help the average forex trader but don’t focus on money management and why it’s important to the beginner trader.

An unknown secret to making a living trading forex is the secret of proper money management. It’s no mistake as to why professional forex traders are able to make profits day in and day out no matter how the trends and currencies swing- it’s because they have an understanding of how much money they should put into certain currency pairs and what percent of their total forex account they need to risk on a daily basis.

I think money management for forex isn’t discussed much because it’s a lot less glamorous or exciting than talking about the best currency pairs to trade or what the favored forex trading platform is.

If you’re a beginner and want to successfully trade forex for a living and continue doing so for years on end then it’s important to get a grasp of how much of your total forex accounts should be put into the markets everyday and when it’s time to call it quits on a trade.

As always, the goal here is consistency, which means no matter how the foreign exchange markets are like on a certain day, it is essential to learn how to turn a profit and not blow more money than you need to.

No matter how ‘boring’ it might seem, it’s extremely important to at least have a basic guideline for how you plan to go about spending and trading your money so that you don’t become part of the majority group who fail at forex trading.

There are horror stories online of people losing one to two to ten years or more life savings in the forex markets. Unfortunately it happens, but even more sad is that a simple plan on how to spend your capital account might have saved these unlucky traders from striking out this bad.

Forex Money Management: Stop Dreaming

A big no-no in forex trading is visualizing lottery trades, which are trades that make you a ridiculous amount of money by unnatural market swings, swings that are almost impossible to foresee and usually involve getting lucky.

It’s best to focus on reality instead of these unrealistic possibilities. The sooner you see forex as a career and less of a get rich quick scheme, that’s when you’ll really start to notice yourself become a better trader and get closer to the goal of making a steady profit.

While a lottery trade is a great thought, there’s also the possibility of a huge loss that will bankrupt you. Not as nice to think about, I know, but these things happen and it’s not conducive to consider the dream of winning big without also considering the nightmare of losing your life savings.

Losing my forex savings would mean going back to a regular job, which I absolutely refuse to do, therefore I make a point to stick to my money management plan and not get ahead of myself.

The sooner you learn to stop dreaming and focus on the reality of the forex markets, the sooner you’ll achieve financial freedom. My lifestyle depends on my success as a full time forex trader, so I am forced to stick to my plan and treat trading as my day job, as opposed to a lottery ticket.

Money Management for Forex: Rule of Thumb

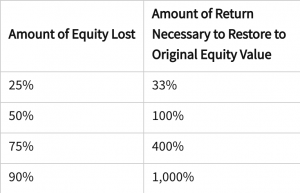

The most basic money management guideline that is common knowledge in forex is to never risk more then 1% of your total equity. The idea here is that you can lose 20 trades and still end the day with 80% of the account you had at the start of the day. If you still have 80% and are a decent forex trader, you should be set to make some of that back the next day.

This is hard concept for some traders just starting out. Especially if you don’t have a lot of capital to begin with, it’s difficult to feel like you’re making any progress by just trading 1% of your account. If you started with $100, that means only entering trades with a dollar.

That being said, it’s okay to slowly increase your bankroll over time by making very small trades. For the novice trader, this will mean that as you become more experience with forex trading that you will also have more money to trade, assuming you are consistently making good returns, and your forex equity account will grow exponentially.

It’s important to understand that when if you have limited beginning capital, you can feel free to trade a bit more than the 1% if you choose. After all, if you feel confident enough to put in 5% of your $100 account, you’re only losing $5 in the chance you lose all of it. It’s not the end of the world.

The rule of 1% becomes more crucial when you have been trading for a long time and have anywhere from $50,000 to $500,000. If you have half a million in your trading account, then putting 1% in a trade means betting $5,000! Imagine losing more than that in a single trade? This is why professional forex traders by nature have a good sense of money management and are able to slowly make more money over time.

Stay humble, stay disciplined and don’t get caught up in fantasies. Craft a money management plan for forex that will allow you to trade day in and day out and stay afloat.

Learn to Trade Forex

If you are a beginner and are still unfamiliar with forex terminology and how the markets work, it’s important to actually learn how to trade if you want be the minority of traders who make money.

Go here to read about a course that teaches the novice forex trader everything they need to know and more.

Also, feel free to grab our Free Forex Trading Fortunes PDF below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.