Table of Contents

Two Types of Forex Brokers: Dealing Desk vs No Dealing Desk

In this post, we will break down and analyze the two types of forex brokers, dealing desk vs no dealing desk brokers.

To start, let’s go over some basics on forex trading and the role forex brokers play.

The foreign exchange market, or simply the forex market, is a decentralized and globally traded market where currencies are bought, sold, and exchanged at varying prices.

Obviously, the goal of forex trading is to extract profits from the trading of different currencies.

In order to gain access to the forex markets so that you can trade and try to make profits, this requires opening an account with a forex broker.

forex broker – these allow traders the access needed in order to trade currencies on the foreign exchange market

Forex brokers traditionally make their money with bid/ask spread – brokers also allow traders the ability to trade with leverage.

Choosing a forex broker is a task in itself. As we’ve mentioned on this website before, for every great, trustworthy forex broker there are a hundred horrible ones – choosing your forex broker is a decision that should be done wisely.

On top of this, there are actually two different types of forex brokers that you can open accounts with.

Choosing which type of broker to open a trading account with is an important decision because it can affect the following:

- the service and customer (trader) support quality

- the size of your trading spreads

- the size of transaction fees

- and much more.

So, choosing the right forex broker is a crucial decision.

Trust me when I say this, having to switch forex brokers after trading for a while is a pain- they don’t make it easy.

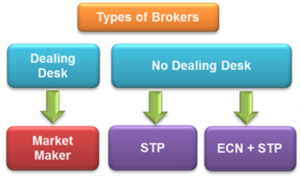

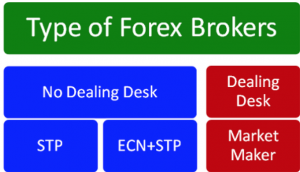

If you are in the process of deciding on a forex broker, it’s essential you know the two different types of forex broker:

- Dealing Desks Broker (DD), also called ‘Market Makers’

- No Dealing Desks Broker (NDD), which includes:

- Straight Through Processing (STP)

- Electronic Communication Network + Straight Through Processing (ECN+STP)

Let’s investigate the two types of forex brokers.

What is dealing desk broker in forex?

Dealing desk forex brokers are also called market makers.

These dealing desk brokers make their fees off of spreads and liquidity.

These types of brokers basically operate on both sides of the trade, as in they offer the buy & sell quote.

Dealing desk brokers fulfil both sides of a clients trade.

They are also called ‘Market Makers’ because they practically create a market for clients – they take the opposite side of your trade.

So, if you lose, they gain. If you win, they lose.

I know, I know – it doesn’t really seem fair. If they are essentially making money on our losses, what’s to say they can’t play dirty? Do some ‘fix the game’ and make it harder for us traders to win?

Market maker dealers typically make their money off the spread, which stays fixed.

The fixed spread is the major upside of trading with this type of broker.

When you go to place an order/enter a currency trade with a dealing desk broker, they find a ‘matching sell order’ to pass your trade onto their clients.

Your order is typically passed onto a ‘liquidity provider’, which is basically a business entity that buys & sells financial assets.

This minimizes much of the risk for the broker – they earn their money off of the spread.

In the event that they cannot find a ‘matching order’, that’s when they oppose your trade (which is when they make money off your loss or vice versa).

Forex brokers all have their own operations and policies, so if you’re interested in how your broker makes their money, simply ask them.

Unfortunately, dealing desk brokers can sometimes manipulate the quote prices for their benefit.

However, because competition between online forex brokers is so fierce, very few of them will even risk their business by rising currency prices – they need to stay competitive with the other brokers.

It’s best to always open accounts with reputable, trusted brokers in order to avoid this.

What is no dealing desk broker in forex?

No dealing desk brokers (NDD) are brokers that don’t pass client’s trade orders through a dealing desk, hence the name.

No dealing desk brokers, or non-dealing desk brokers, is a category of two different types of brokers:

- Straight Through Processing (STP)

- Electronic Communication Networks (ECN)

These brokers do not ever take the opposite side of a clients trade – they simply act as a middle man between the trader and the financial entities (ie. banks, funds, etc)

No dealing desk brokers make their fees from either

No Dealing Desk Brokers, image courtesy of babypips.com commission fees, or

- relatively small mark-ups in the price of the spread.

The offered spread is not fixed though they tend to be lower, as compared to DD brokers. Since they are not fixed, the spreads can increase drastically when the forex markets are volatile (which tends to occur during big economic announcements, such as the NFP figures).

Let’s go into the two different types of no dealing desk broker’s, STP & STP + ECN.

What is an STP forex broker?

Forex brokers who use straight-through processing (STP) system link trader’s currency orders to entities/liquidity providers (such as banks, funds, etc.)

You (the traders) orders are routed directly to the liquidity providers who have direct access to the interbank market (the forex markets).

STP forex brokers earn by marking up the spread.

If you are trading through an STP broker, then the currency pair prices (bid/ask prices) that you are shown are already marked up.

You are not shown the actual original price of the currency prices.

As mentioned previously, the size of the spreads will change depending on market volatility, economic news, etc.

That said, a small portion of STP brokers will still offer fixed spreads.

What is an ECN forex broker?

Brokers who use an electronic communication network (ECN) provide you with direct access to other liquidity providers and participants of the ECN.

These ECN ‘participants’ could mean

- traders

- banks

- funds

- other forex brokers

ECN forex brokers provide the ability for traders to trade with other liquidity providers.

These ‘participants’ then trade with one another by offering competitive bid/ask prices.

ECN brokers also give traders access to see what we call depth of market.

depth of market – a window that displays the amount of open buy & sell orders for currency pairs (this measures how liquid a certain currency might be)

Essential, depth of market shows where the buy/sell orders of other ECN participants are.

Instead of earning their fees off of spreads, these ECN brokers will typically take a commission from your trades.

What is the best type of broker in forex?

Figuring out which forex broker to use can be a difficult decision to make, especially for those new to forex trading.

The fact of the matter is that you get to decide – neither broker type is necessarily better than one another.

Some people suggest dealing desk brokers for beginners to forex, simply because they usually offer the ability to trade in nano lots, which means smaller money to trade.

Others suggest non dealing desk brokers because they offer better spreads, although the commission they take may sometimes combat this.

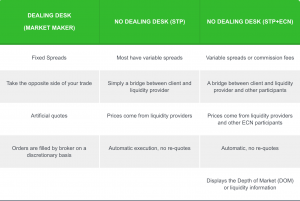

BabyPips has a great comparison chart for the different types of forex brokers, which I will include below.

The decision is ultimately up to you, trader.

If you are unsure of which type of forex broker to use, then it may mean you aren’t ready to trade yet.

For the beginner forex traders who aren’t familiar with forex yet, then I suggest educating yourself on how to trade forex first.

Learn to Trade Forex

For those who are new to forex and want to learn, as fast as possible, how to make money trading, I recommend educating yourself with a proper course.

The benefits of a forex course (as opposed to free online content, such as this website) is that is cuts out all the excess fat and gives you the best strategies and methods for how to trade forex successfully.

If you are new to forex trading and want to learn the same strategies that my forex friends and I use to make six-figure salaries year after year, this forex course is your best bet.

It’s important to put in the time to learn how forex trading is really done.

Also, if you haven’t already, make sure to grab our Free Forex Trading Fortunes PDF – get your copy sent straight to your email below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.