Table of Contents

What is Forex Lot Size?

I see the question asked way too often online- What is forex lot size, and why is it important to me?

There seems to be many novice forex traders who struggle with some of the nomenclature used in the world of forex trading. In order to learn to trade and make sense of the resources available online, it’s important for the beginner forex trader to understand these key terms so that they can focus on the more important information about how to actually make money.

A question I see asked online often is about what lot and lot sizes are in forex.

A lot in forex is a specific amount of currency, usually meaning the minimum trade size that the trader my place on a currency pair.

There are micro lots, mini lots and standard lots. More on this later.

It is, essentially, just the quantity or volume of units.

Lot size in forex is basically a unit of measurement for the position or trade size, the number of units of currency that you will buy or sell.

What lot size in forex refers to is the amount you are risking when you enter a trade in a currency pair.

This is why it’s wise to get a good understanding of what lot size is and how it effects trades in forex.

In this article I’ll explain lot size in more detail and provide you with some tools to help you choose the right lot size for you.

Forex Lot Size Chart

To understand forex lots it helps to know what pips are.

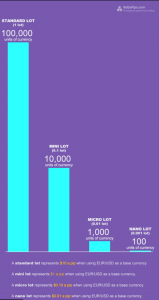

The picture to the right explains the different forex lot sizes.

As you can see, the there are three main categories of lot sizes commonly used in forex terminology. (Nano lot size are very rarely used).

The three sizes are:

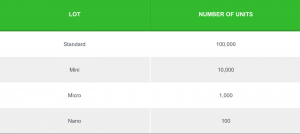

Micro lots- typically the smallest trade-able lots that traders are able to use, which is 1,000 of the currency your account holds.

Micro lots are great for beginners as it minimizes the risk you take on trades as you start to figure out how the markets works.

Mini lots: a mini lot is 10,000 units of the currency your account holds.

Beginner’s are still encouraged to use mini lots, however it’s important to make sure you have enough capital to sustain trades of this size.

Standard lots: a standard lot is 100,000 units of the currency your account holds.

Standard lots are almost exclusively used by large firms or seriously wealthy forex traders. If you are trading with standard lots, when down by 10 pips this means you are down by $100, if using USD.

This is a lot, especially compared to how much the average forex trader has in their account at a time.

Most forex traders will be using either mini or micro lots.

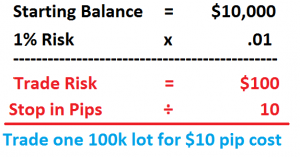

It is better understood when thought of the ratio of pips versus lot sizes.

1 pip is roughly equal to 10 cents, considering you are trading USD currency, with a micro lot size.

1 pip is roughly equal to $1 USD, considering a mini lot size.

1 pip is roughly equal to $10 USD, when considering a standard lot size.

The lot size determines how risky your trades are relative to pips.

For example, a 150-pip trade on a small lot micro trade will not be nearly as risky as a 150-pip move on a standard lot trade.

It’s important to be smart about your lot size when trading forex, especially for beginners, which leads me to my next point.

Choosing Lot Size in Forex

As mentioned, choosing your lot size in forex is essentially deciding the impact that moves on the market will have on your account(s).

Choosing the right lot size for you mostly depends on two things:

- Your ability and experience level with forex trading.

- The size of your forex account (ie. how much capital you have).

Lot Size and Pips

The better you are at forex trading the easier it will be to figure out the correct lot size you should be using.

Again, most traders fall under either the mini or micro lot size category.

The lot size you choose is essentially the amount of risk you are taking on a certain trade, which should directly correlate with your experience level and the amount of money you have to back it up.

One of the best ways to determine your recommended forex lot size is by using a forex lot size calculator.

Forex Lot Size Calculator

There are various tools online that will allow you to determine the correct lot size for you. These tools calculate your correct lot size depending on factors such as your current forex account size. It is similar, in a way, to money management since it allows you to make calculated decisions on how much of your account you are risking in a trade and whether a certain forex trade is worth it or not.

A great service that the website earnforex.com offers is an actual position size calculator.

This tool allows the trader to enter their data (including the size of your account, the currency you are trading with, and your risk ratio) and it will punch out an accurate amount you can afford to risk.

Until you are an expert, I suggest using this free tool before every forex trade you decide to enter.

Learn to Trade Forex

The concept of forex lot sizes are better understood if you are already familiar with basic forex strategy. If you are not, it’s important to educate yourself on the ins and out of the forex markets.

Take your time to peruse this site a bit more and get a better understanding of what forex actually is and how you can go about making a living from it.

If you want to learn everything you need to know about forex and more, go read about a forex mentoring course that will get you from complete novice to educated trader in a matter of weeks.

Also, make sure to grab our Free Forex Trading Fortunes PDF – get your copy sent straight to your email below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.