Table of Contents

What is forex spread?

A lot of beginners to forex trading always ask me “What is forex spread?”

It is a concept often mentioned but not always explicitly explained so therefore often misunderstood.

Knowing what forex spread is, what forex spread is used for, and what determines forex spread are all very important questions that I will explain in detail in this post.

Before I answer ‘what is forex spread”, it’s necessary to briefly offer some background on currency trading for those that don’t know.

Some quick, important points to note before learning about forex spread:

- market prices in forex are shown as currency pairs, which means the value of a certain unit of currency is denominated of another unit of currency (ex. EUR/USD)

- the base currency represents how much of the quote currency is needed for you to get one unit of the base currency

- the quite currency price is how much you need to get one unit of the base currency

- the base currency (in the EUR/USD example) is EUR, the quote currency is USD

- if EUR/USD= 1.55, then in order to purchase 1 EUR, it costs 1 USD

Currency pairs, base and quote currencies form the basis of forex and how it works.

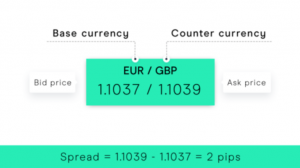

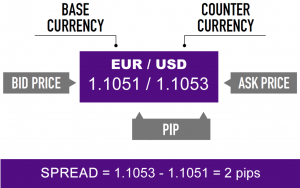

In order to understand forex spread, you also need to know about the terms BID and ASK.

- the price of which the base currency can be sold is the bid

- the price of which the base currency can be bought is the ask

- a BID is always lower than the ASK

The BID and ASK are both different prices that are quoted by a forex broker.

What is spread in forex? What determines forex spread?

forex spread – the difference between the BID and ASK prices

Essentially, forex spread is how brokers (especially those who take no commission) make their money.

The cost of trading forex is included in the prices of the currency pairs by the brokers.

Hint: You can think of it as a ‘tax’ the forex brokers place on their product (the currency pairs).

Many brokers implement forex spread as a way to make fees while also earning the right to advertise themselves as either a “no commission” or “zero commission” forex broker.

What is spread in forex trading measured by?

Forex spread is typically measured in what we call pips.

pip – absolute smallest unit of movement of a currency pairs price

A single pip, for most currency pairs, equals 0.0001.

A pips value changes because it is the smallest possible measurement of a currency pair, and

sometimes currency pairs have varying decimal places.

EUR/USD is expressed as 4 decimal places.

So, let’s say EUR/USD is 1.1051/1.1053 (bid price = 1.1051, ask price = 1.1053)

This is a difference of 2 pips, or 2 points (1.1053 – 1.1051 = 0.0002).

This is only an example of how forex spread can look.

Types of spread in forex

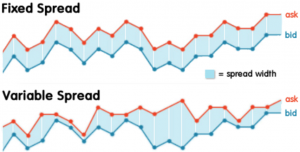

There are actually two types of spread in forex.

The type of spread you might come across depends entirely on your forex broker and how they choose to make their money.

The two types of spread in forex are:

- Fixed spread

- Variable spread (aka floating spread)

Let’s take a look at both of these a bit more in-depth.

What is forex fixed spread?

fixed spread – the ASK and BID price difference stays constant, despite any changes in market conditions

As the name suggests, fixed spreads are the ones that stay the same. If the market is particularly volatile, it does not change the spread you are paying for.

A fixed spread is typically offered by brokers who use operate by the ‘dealing desk’ model.

For traders who might not have a large amount of capital in their account, a fixed spread is usually preferred.

It allows the benefit of knowing how much the transaction costs will be – you won’t be blindsided as you might be with a variable spread.

However, there are two downsides of fixed spread, which are:

- requotes – if the market is particularly volatile, your broker might block you from entering a trade so they can adjust the spread (since they aren’t able to change it while you are already in a trade since it is fixed). Since pricing comes from your broker and your broker only, they have the ability to change as they please. If you are blocked from entering a trade so they can offer a new spread, you can be sure that it will be more expensive then it was before.

- slippage – this can also happen. Slippage occurs when prices are changing rapidly and the broker cannot maintain a fixed spread, so the price ends up being different than the entry price you originally agreed upon. (I know, it doesn’t seem fair).

These two downsides are a couple of reasons why some traders prefer variable spreads.

What is forex variable spread?

variable spread – the spread will change in correlation with the market

Typically, a variable spread tends to lower during times when the market is less active.

However, when the market is particularly volatile, the spread will (naturally) fluctuate widely.

A variable spread is sometimes preferred because it generally imitates the real market, but it makes strategy difficult as a trader is left uncertain as to how much they are spending on the spread.

Variable spreads are usually offered by non-dealing desk brokers.

Since the broker does not have direct control over their spreads, the spread changes based on the overall supply and demand of currencies in the market.

Global news and economic data releases, such as non-farm payroll figures, can change the variable spread sizes drastically.

Variable spreads are preferred by some traders simply due to the negative aspects that come with fixed spreads, ie. requotes and slippage. However, slippage does occur with variable spreads.

Forex traders also appreciate variable spreads because the spreads tend to be more predictable (which may seem surprising compared to the idea of a fixed spread). This is because prices are mostly based off of the market.

Variable spreads, while appreciated by some traders, do not work as well for news traders and scalpers.

Learn to Trade Forex

Knowing key terms like ‘forex spread‘ is a great stepping stone to mastering the art of forex trading and getting on your way to becoming a full-time, successful trader.

That said, simply memorizing key terms will not actually help you in the actual trading aspect that comes with forex trading.

In order to learn how to trade, you need to know how the markets work, proper strategy, and how to extract profits from the market no matter how it’s performing.

If you are a beginner forex trader and want to learn how my friends and I make six-figure salaries, year after year, solely from forex trading, make sure to go ahead and read our Forex Mentor Pro 2.0 Review.

The goal of prosperous forex trading is all about consistency, making a profit every single day.

Also, if you haven’t already, make sure to grab our Free Forex Trading Fortunes PDF – get your copy sent straight to your email below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.