Table of Contents

The Story of GEORGE SOROS

How One Forex Trader Made a Billion Dollars In One Trade

Forget forex millionaires… today we’re talking about a forex trader who made a billion dollars in a single trade.

George Soros was nicknamed “The Man Who Broke the Bank of England” because, well, that’s what he did.

Let’s take a look at how one man made the most successful forex trade in all of history.

Who is George Soros?

Early Beginnings

George Soros, legal name Schwartz György, was born in August of 1930 in the country of Hungary to a well-off Jewish family.

Unfortunately, George Soros and his family were ‘uncomfortable’ with their strong Jewish roots, as were others at the time, and he was raised in an antisemitic household.

George’s mother was a silk shop owner, his father a lawyer and public speakers.

When he was just 13 years of age, Nazi Germany came to occupy Hungary – subsequently, Jewish children were banned from school and were forced to report to a ‘Jewish Council’.

The Soros’ family survived these times by buying documents that claimed they were of Christian faith.

On one occasion, George’s father took him on a journey in which he used his profession to save other Jews – George later wrote that this time (the year 1944) was ‘the happiest year of his life’… the reason? Because he was able to bear witness to the heroic acts of his father.

The family survived the Siege of Budapest and in 1947, George left to England to study at the London School of Economics.

During his studies, George was both a restaurant waiter and a railway porter.

George graduated from his studies with a Bachelor and a Master of Science in philosophy.

Not the line of studies you might expect a future billionaire and finance legend to be in, is it?

Investment Career

In 2006, a reporter from the Los Angeles Times asked Soros the question, “How does one go from an immigrant to a financier? … When did you realize that you knew how to make money?”

Soros responded, “Well, I had a variety of jobs and I ended up selling fancy goods on the seaside, souvenir shops, and I thought, that’s really not what I was cut out to do. So, I wrote to every managing director in every merchant bank in London, got just one or two replies, and eventually that’s how I got a job in a merchant bank.”

Again, seems like humble beginnings for an icon, doesn’t it?

This is why I like the story of George Soros so much and why I consider him such an inspiration, not just for forex traders but for anyone who desires to do something significant or out of the ordinary – it’s an underdog story.

Soros started his career in 1954, at 24 years of age, as a clerk for a merchant bank.

Two years later, Soros moved to New York City and began working as an arbitrage trader… specializing in European stocks (this will be the key to his success!).

Another three years passed, and George moved back to England – with the goal of continuing his studies in philosophy.

Yes, that’s right, the most successful forex trader of all time was finished with finance.

In 1963, Soros quite his job as a securities analyst (specializing in European securities) and began developing his ‘theory of reflexivity‘.

George Soros ‘Theory of Reflexivity”

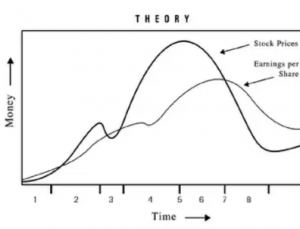

The ‘Theory of Reflexivity” is an [somewhat] advanced theory that focuses on how ideas and events influence one another, leading to the ‘vicious’ boom and bust cycles of the markets.

Essentially, the idea is based on the presence of two realities:

- objective realities, and

- subjective realities.

Objective realities are those that remain true, despite what others think of them, such as someone saying it is raining outside while it is raining. Even if someone were to argue that it is not raining, that doesn’t change the fact that is is a reality that it is raining outside.

The opposite of this are subjective realities – these are affected by others and how they think about them. This is where predictions and judgments fall under.

For example, we can try our best to gauge how a stock might perform and how it should be valued… and this is what drives the markets. The way we think about these things, collectively, has the power to move markets – so, the way we think about reality affects reality itself.

See the difference?

Amazon, relative to its market cap, has made little profits for over 15 years.

Does that matter though? NO.

Since so many people have faith in Amazon and everyone continues to buy up their stock , perhaps because they believe Amazon may one day make a lot of money, which is a fair assumption.

But, thanks to everyone believing in Amazon, this has impacted the companies a subjective reality.

Would Amazon be as successful as they are today if they had to focus only on profits? Would Jeff Bezo’s be the richest person in the world, with a net worth of over $150 billion?

Probably not.

This is an example of how our subjective reality can change reality and is an essential part of George Soros’ theory of reflexivity.

George is saying markets are not reality – far from it.

Prices are wrong, divergence can be large, and this can create boom and bust processes.

As traders, these large divergences are where we can make the most money – this is what we are looking for.

Here’s a great video that briefly explains Soros’s Theory of Reflexivity:

Hedge Funds

After returning to England and developing his theory of reflexivity, Soros’ worked as a vice president for an investment bank and went on to set up a Hedge fund.

Riding off the success of these ventures (and the wealth he had saved), Soros founded ‘Soros Fund Management’ and started his position as its chairman.

Later renamed the Quantum Fund, the value of its capital grew to over $400 million.

(In 2013, Quantum Fund made just over $5.5 billion, effectively making it history’s most successful hedge fund of all time).

Despite his success, George Soros had yet to make the trade that made him both a billionaire and a forex trading icon.

Black Wednesday

Leading up to September 1992, Soros built a very large short position (an assumption that the value will go down) of pounds sterlings, also known as pounds, the official currency of the United Kingdom.

George had done this upon recognizing that the UL had an ‘unfavorable’ decision in the European Exchange Rate Mechanism, or ERM (funny enough, the ERM system was designed to help Europe achieve monetary stability throughout the continent).

Soros believed that the rate that the UK was brought into ERM was much too high, as was their inflation, and that the interest rates in Britain were hurting asset prices.

Anyways, let’s just say he was right.

On September 16, 1992, a day that was forever dubbed ‘Black Wednesday‘, Soros’s fund sold short more than $10 billion in pounds. They effectively profited from the UK refusing to raise interest rates or float its currency.

What happened next made George Soros a very famous man.

The UK withdrew entirely from the ERM, which completely devalued the pound… our friend George was betting on this, and he made a profit of over $1 billion.

The Man Who Broke the Bank of England

Geroge bet on a massive position and profited accordingly.

It’s safe to say that this pissed off a few people.

The Bank of Finland and the Finnish Government considered that Soros may have been trading billions in the Finnish currency, and were worried that he was assuming it would crash as well.

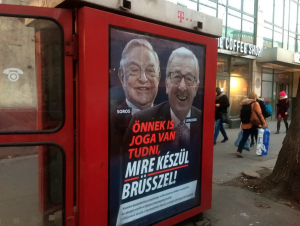

The Malaysian prime minister, during the 1997 Asian financial crisis, claimed that Soros was abusing his wealth in order to punish them for political reasons.

The very same prime minister said that ‘It is a Jew who triggered the currency plunge’, suggesting that the crash was one part of a large Jewish conspiracy.

Journalists and critics alike have commented for years on the ethics of Soro’s effects on the financial markets.

While many focus on the insane amount of money that Soros made on this day, the event also pointed out many lessons for both the government and people, such as:

- the government should not dictate interest rates.

- the government should not take measures to counteract the decisions of speculators.

- be prepared for extreme measures.

- nothing is impossible.

My opinion?

George Soros was in the right place at the right time and was able to see something that not many others did.

And what did he do? He profited from it, and he did it big-time.

What would you do in this situation?

Present Day

It’s safe to say that George Soros went on to have a successful and prosperous finance career.

His fund continued to thrive, and since 1973 the fund has generated over $40 billion.

Soros has lent his hand to numerous philanthropic efforts and ventures.

In 2009, Soros founded the Institute for New Economic Thinking (done in response to the late-2000s recession), a ‘think tank’ composed of finance and economic experts who focus on taking new approaches to international financial and economic organization.

Soros has donated plenty of money towards various socioeconomic efforts, such as donating $35 million to New York City for underprivileged children, and occasionally politics, including a casual $1 million to the campaign of Barack Obama’s reelection.

George has also dipped his hand into Eastern Europe communist societies, donating to various movements and governments in an attempt to promote the ‘free flow of ideas’.

Soros is also an outspoken advocate of drug policy reform, donating millions to help decriminalize substances and help those who are wrongfully incriminated to be released from prison.

Soros’ retired completely from money management for clients in 2011, passing control of his firm over to his sons.

Soros has been publically critical of Facebook.com founder and CEO Mark Zuckerberg, claiming that the entrepreneur has a ‘Mutual Assistance Arrangement’ with current USA president Donald Trump.

He has been married three times and has been with his current wife Tamiko Bolton since 2013. He has five children, although none are from his current wife.

PBS estimates that as of 2003, Soros has given away $4 billion.

In October 2017, Soros announced that he had transferred exactly $18 billion to Open Society Foundations, his own grantmaking network.

Attempted Assassination

In October 2018, a pipe bomb was placed inside the mailbox of Soros’ New York home.

Luckily, the bomb was found by a caretaker – it was removed and the authorities were notified.

As it turns out, an investigation by the FBI discovered that similar bombs were mailed to Barack Obama, Hilary Clinton, and other members of the left, Democratic and liberals.

Cesar Sayoc, arrested in Florida, was sentenced to 20 years for the mailing of 16 total pipe bombs – none of them exploded.

What is George Soros Net Worth?

In 2017, Forbes magazine listed George Soros as the 29th richest man in the world, the richest hedge fund manager in the world, and the 19th wealthiest American.

His net worth was estimated at $25.2 billion.

Surprisingly enough, this is after he lost about $1 billion after Donald Trump was elected as president (possibly related, but Soros has labeled Trump as a ‘con man’ and expects him to fail since his ‘ideas are self-contradictory’.

Where does George Soros live?

As far as public knowledge goes, Soros has many houses in the state of New York, in neighborhoods and areas such as:

- Manhattan’s Fifth Avenue

- Manhattan, Upper East Side

- Katonah, New York

- Southampton

Best George Soros Books

Here are a few of George Soros’s best and most popular books, in no particular order.

The Alchemy of Finance by George Soros

This book is my personal favorite of Soros’s.

Written in 1987, this book is a complete introduction to the past century’s financial trends – George breaks it all down for the reader and gives the reader an underlying explanation of how the financial system’s in the world work.

Hint: this is a fantastic resource for forex traders!

This book also explores Soros’s famous theory of reflexivity and does so in a way that truly anyone can understand.

Open Society: Reforming Global Capitalism by George Soros

As mentioned previously, Soros is passionately dedicated to building an open society, especially in countries dominated by communism.

This book is a great explanation of the open society idea and will be a great read for anyone interested in this topic.

Financial Turmoil in Europe and the United States: Essays by George Soros

This book is a collection of essays that focuses on some of the largest economic crises of our modern time.

It is a great geopolitical commentary and offers explanations of the economics of the last couple of decades.

George Soros on Globalization by George Soros

This book explores what globalization actually is and how it affects people and countries.

Soros does a great job of breaking down a complex topic into an easily understood idea, and it is just as entertaining to read.

The Age of Fallibility: Consequences of the War on Terror by George Soros

This book looks at the War on Terror and how it has affected the United States of America.

The crazy thing about this book?

It predicted the Crash of 2008 – this in itself makes it a fantastic yet harrowing read for anyone interested in these topics.

George Soros Quotes

As you can expect, a man of such wisdom and wealth (and controversy) is bound to have some valuable insights to offer.

I’ll leave you with these to ponder- thanks for reading.

“How can we escape from the trap that the terrorists have set us? Only by recognizing that the war on terrorism cannot be won by waging war. We must, of course, protect our security; but we must also correct the grievances on which terrorism feeds. Crime requires police work, not military action.”

– Address at University of Pennsylvania (2002)

“Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.”

– Unknown location (2005)

“The main difference between me and other people who have amassed this kind of money is that I am primarily interested in ideas, and I don’t have much personal use for money.”

– From the book ‘The Winning Investment Habits of Warren Buffett & George Soros’ (2006)

“The truth is, successful investing is a kind of alchemy.”

– From the book ‘The Alchemy of Finance: Reading the mind of the Market’ (1987)

“My peculiarity is that I don’t have a particular style of investing or, more exactly, I try to change my style to fit the conditions.”

– From the book ‘Soros on Soros’ (1995)

“I’m not doing my philanthropic work, out of any kind of guilt, or any need to create good public relations. I’m doing it because I can afford to do it, and I believe in it.”

– From an interview with David Brancaccio (2003)

________________________________________________________________

Sources

https://paxforex.com/forex-blog/how-george-soros-made-billions-on-forex

https://en.wikipedia.org/wiki/George_Soros

https://www.investopedia.com/articles/insights/081116/how-did-george-soros-get-rich.asp

https://www.investopedia.com/articles/forex/08/greatest-currency-trades.asp

Learn to Trade Forex

If you are looking to learn how to trade forex, go check out our post about a mentorship program that will take you from beginner to pro in weeks.

If you haven’t already, make sure to grab your Free Forex Fortunes PDF – look below to get your copy sent straight to your email today.

[convertkit form=1499651]Who is George Soros?

George Soros is a Hungarian-American billionaire and financial magnate, also known as ‘The Man Who Broke The Bank of England’ when he made an extremely profitable currency trade on a day known as ‘Black Wednesday’.

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.