Table of Contents

What is Forex Scalping?

Forex scalping is a fast paced method that traders use to extract profits from trades in a short amount of time.

Instead of entering a trade and waiting for it to either go up or go down, forex scalpers are taking advantage of volatile fast moving markets and are trying to slowly build capital from small but frequent trades.

While many traders take time and evaluate their trades, forex scalping is a much more accelerated strategy. Although forex scalping involves being entered into a currency trade for a short amount of time, the higher frequency of entering and exiting trades makes up for the limited amount of pips you can collect while being in a trade for such little time.

Forex scalping is similar to most day traders basic strategy; it is common to not be entered in trades for very long nor remain in trades overnight.

The difference between scalping and typical forex strategy is just the speed of entering and exiting trades.

Many forex scalpers are forced to stay glued to their computer screen, since they are relying on sudden fluctuations of currency prices. Forex scalping demands a much more intense focus as opposed to typical day trading.

If you hope to make money with scalping, it’s important that your eyes do not leave the computer screen. To get up for a couple minutes means possibly missing out on opportunities or losing a bit of money.

While it may seem of minor importance, the way forex scalping works is by adding up all the little profits you earn during the day which makes up your full day’s income. If you miss out on small wins or are losing small losses, even occasionally, that can eventually add up and be detrimental.

A good forex scalper is concentrated on every little detail because they know it’s those minor details that make up their income.

To be successful with forex scalping, you need to be quick with your thinking and with your hands.

While it may seem that it is a less logical strategy of trading forex, scalping actually requires the ability to make sense of information overload that traders face when trading. Forex scalpers must be able to quickly process and analyze data to try and determine which trades to enter and when to exit, sometimes in less than a minute.

If you are interested in giving forex scalping a try, it is recommended that you already have a good understanding of the markets and what causes the sudden price changes in currency pairs.

This is because forex scalpers often rely on the brief period of time where currency prices rise or fall due to the release of relevant economic news or data.

An example of this would be the announcement of GDP figures, which might have a sudden effect on a currency price that the forex scalper can use to their benefit.

One thing important to note is that sometimes forex scalpers trade with higher volumes during their sessions to see a profit. Where typical traders might stick to the common 2% volume rule, scalpers may trade much more volume to make the most of the short and small fluctuations in currency prices.

Here’s a good video that explains how scalping works and how to do it, courtesy of The Secret Mindset on Youtube.

Best Forex Scalping Strategy

The most used scalping strategies involve either 1 or 5 minute trades.

With the 1 minute strategy you are usually aiming for about 5 pips, while with the 5 minute strategy the goal would be closer to 10 pips per trade.

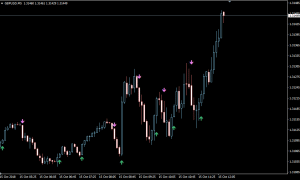

The idea is to choose currency trades that are likely to be volatile, so that you can then profit off these rapid fluctuations of price.

You also want to choose a pair with a low spread, where it will be cheap for you to trade.

Along with a low spread, the currency pair must also have favorable conditions. A common method forex traders use to identify these conditions are forex indicators.

Once you are in entered in the trade, you either exit when you reach your maximum loss (you can use stop loss for this) or when you’ve reached a profit that you are satisfied with.

Usually, it is recommended that you have a set strategy for how much money you expect to win or lose on each trade- this is where money management comes into play.

No one can decide for you exactly how much you should expect to win or lose on a trade whether you are scalping or trading regularly. This all depends on your experience level and size of your forex account.

Learn to Trade Forex

Forex scalping is a great strategy for traders who know what they are doing and are comfortable with the intensity this particular strategy requires. Scalping is a rapid action yet a long term strategy that many traders utilize in order to produce a full time living from forex trading.

That said, it is not recommended to give forex scalping a shot unless you are already trading comfortably. If you don’t understand how the forex markets work, it will be very difficult to make a consistent income from forex trading with this strategy.

If you are new to forex or want to take your knowledge and trading skills to the next level, it’s important to participate in a proper trading course if you want to really make a living trading.

The harsh reality is that most forex traders fail. It is difficult to make sense of all the information out there about forex trading and to directly apply that to the real live markets.

If you are ready to actually start making consistent profits through currency trading, I recommend you read my post here about a forex mentor course that will teach you everything you need to know and more about how to consistently make a living from forex trading.

Want some free help with forex trading? Check out our Free Forex Trading Fortunes PDF, a comprehensive guide on how to make profitable forex trades.

Get your copy sent straight to your email today below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.