Table of Contents

Is Forex Trading Really Worth It?

It’s no secret that forex trading is a dangerous game for most people.

In fact, I’ve even heard from reputable sources that the success rate for forex traders is less than 10%.

This leaves many wondering, is forex worth it?

It depends.

According to The Balance, over 96% of forex traders lose money and quit trading… a pretty grim statistic.

So, the simple answer to the question “Is it worth trading forex?” would be probably not.

This is because most forex traders fail.

What do I mean by that?

When I say most forex traders fail, it simply means that these traders fall into one of two categories:

- A trader ends up losing more money then they make, thus coming out with less money than they started with.

- A trader does not reach their set trading goals, which means they essential ‘failed’.

The concept of someone losing money in the forex markets (as opposing to making money) is really grim, and I struggle to understand why so many people are so easily led into dumping money into financial markets that they have no clue about.

Is forex trading really worth it, then, if most traders fail?

The answer really depends on how much time you are willing to put in and if you’re prepared to lose some money before you make it.

But yes, it is true that most forex traders fail – and it’s just what it is.

Trading currencies can be a difficult game, and the high volatility of the forex markets can make it easy to either make a lot of money very quickly or lose it all, very quickly.

Most people are not prepared to invest the money and time necessary to really understand forex trading and how profitable trades are made.

This means that, for most people, forex is not worth it.

Forex is an insanely popular industry and can even be described as a ‘fad’ – lots of misinformation exists on the internet, so much so that most people don’t even know what forex actually is.

Many internet users are blinded by the ‘get rich quick’ schemes in the forex industry and are led to believe that currency trading is a fast track to online riches, which is simply not the case.

The truth is that most forex traders fail.

Now, that doesn’t mean that if you’re on the fence about starting forex trading that you should give up just yet – this simply means that most people fail.

On the other side of the coin, I have personally come across hundreds to thousands of forex traders who are making a great living just from trading currencies on the forex markets (and good livings at that!)

Most forex traders who have put in their time (I’m talking 5-10 years of work) are making at least low-level six-figure salaries, while a good portion is making much more than that (up to half a million a year for the pros!)

So, is forex trading worth it?

This is a decision that you must make yourself.

However, what I’ve realized is that most traders who fail do so for the same reasons as others.

This includes:

- Low starting capital (not enough money put in at the start)

- Poor risk management practices

- Getting greedy

- Involving emotions in trading

- Using crappy forex systems or indicators

- Trying to beat the market

Fortunately, most of these issues can be fixed.

For example, if you have low starting capital, then this means you probably can’t afford to trade forex – which means for you, forex is not worth it.

If you are trying to ‘beat the market’, then you are probably not familiar with trends and patterns, so you should go and learn forex trading first – in this case, forex trading is not worth it.

If you are relying solely on internet-bought forex robots, indicators, or systems for your trading, then for you, forex trading is not worth it.

If you are involving emotions in your forex trading then you are certainly not utilizing proper risk management.

If you are getting greedy and trying to win as much money as possible, you are not using proper risk management.

What am I getting at?

Most traders who already know how to trade forex and have enough capital end up failing because they are not practicing risk management, and are not evaluating their risk to reward ratio.

These are issues that can be fixed.

In this post, I will go over some of the most common risks that forex traders face and how you can manage these risks so and you can avoid becoming just another addition to the majority of forex traders who fail.

Risk of Forex Trading

Yes, there is a risk of forex trading.

While I know this is obviously not surprising for most people, unfortunately, the overload of false marketing and crappy products in the forex industry has led some to believe that trading foreign currencies is an easy way to get rich fast.

Obviously, this is not true – however, forex trading can be very lucrative and has made many people millionaires.

The forex markets are highly volatile.

Volatility – in forex, this means big swings in either direction

Because currency pairs can drastically shift in value (in a matter of minutes), you can make back profits very quickly.

Volatility can stem from a number of sources, such as:

- Economic news

- Politics

- Analytic news

- Interest rate changes

- Company announcements

- Other forex traders

While high volatility can mean big profits, it can also mean large losses.

Now, this sounds scary, but read this:

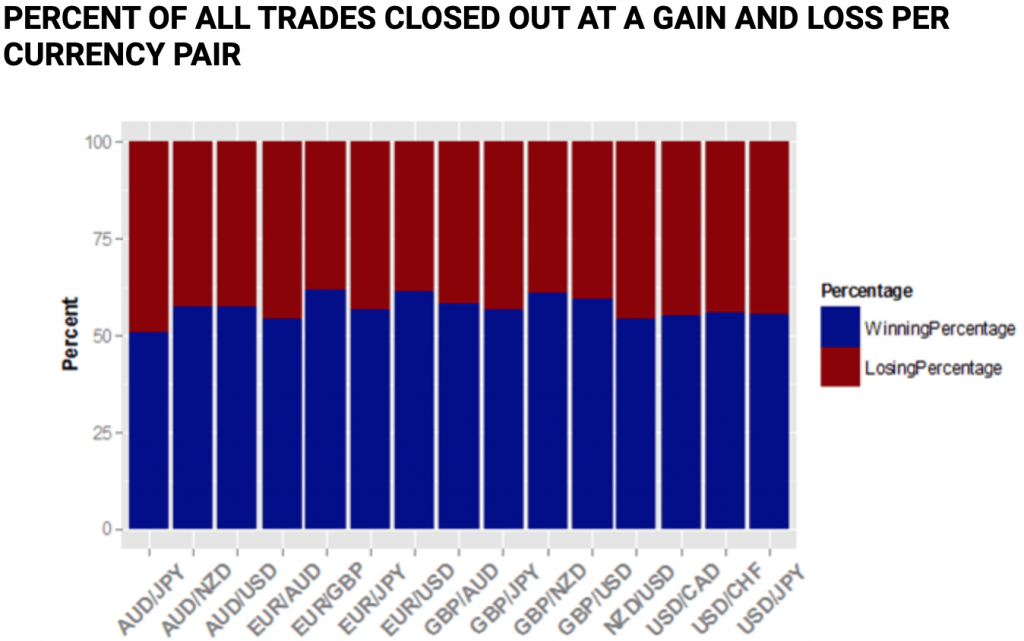

The popular forex website DailyFX did a study on 43 million forex trades to evaluate performance… what they found was very interesting.

The study revealed that the overwhelming majority of trades were actually successful, meaning that traders came out on top.

BUT, they also found that overall, traders are still losing money.

Why is this?

This failure has everything to do with risk management.

Forex Risk Management

The DailyFX study reveals something very interesting about forex trading, which is that while most trades are successful (since most traders at least know something about how forex trading is done), that most traders still end up losing money over the course of their career.

This is similar to the methodology of gambling addicts – while they might win some bets, over the course of their career they will likely lose money because they don’t know when to stop.

This is where risk management in forex comes in.

Risk management is crucial if you hope to minimize your losses and prevent total bankruptcy.

Some simple ways of managing your risk in forex include:

- Knowing what you’re getting yourself into

- Only invest money you can afford to lose

- Don’t overuse leverage

- Have a plan

- Manage your emotions

- Utilize stop loss

- Set realistic profit goals

- Don’t put all your eggs in one basket

Being realistic about trading forex and being as strict as possible with the rules you set for yourself are majors keys to success.

Typically, it is when traders get carried away and start dreaming of unrealistic profits when the reality is lost – this leaves the trader chasing riches that are simply not doable.

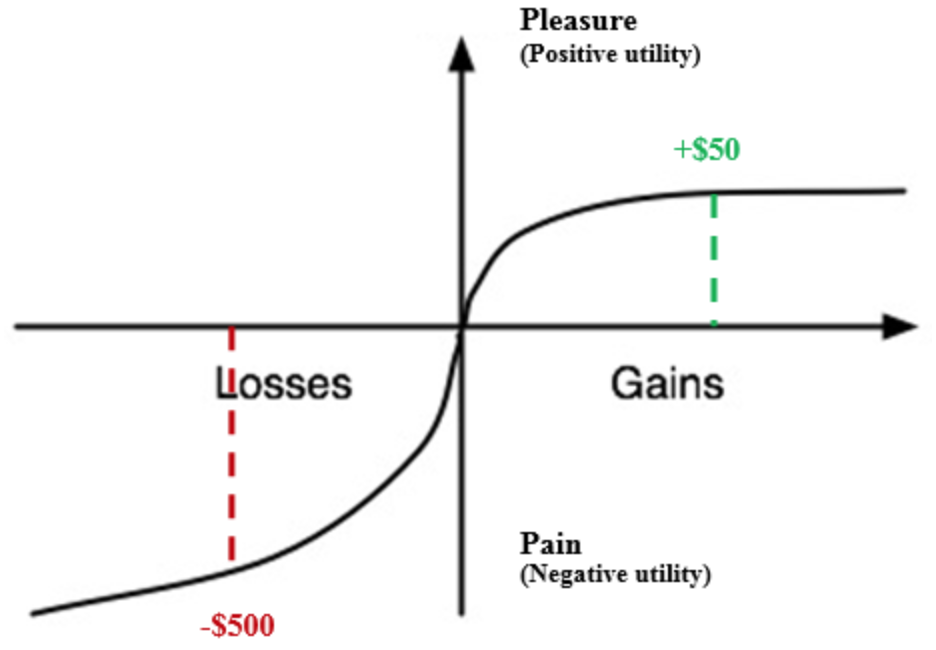

DailyFX wrote about a psychologist who, during his various studies and research, found that people take much more pain from losses than they do pleasure from gains.

The concept is called Prospect Theory.

Source: DailyFX

How does this relate to risk management?

Traders are willing to risk high losses in order to make up for other losses.

Simply winning a big trade is not enough for most people – no matter how much a trader might win, they are focused on how much they lost… they will keep trading to make this money back, which more often than not leads to massive losses.

Again, this is why risk management is so important – emotions have no home in forex trading.

Thankfully, you don’t have to forfeit high returns on your trades by implementing risk management – it’s all about balancing the risk to reward ratio.

Forex Risk to Reward Ratio

Your risk to reward ratio (or reward to risk ratio) is a measure of how much reward you have to potentially gain for how much you risk.

A 1:1 risk-reward ratio means you are risking a single dollar ($1) to possibly make a single dollar ($1).

A 1:3 risk-reward ratio refers to a trade where you are risking $1 to possibly make $3.

Understand?

It is a mathematical way of assessing your trades before you enter them.

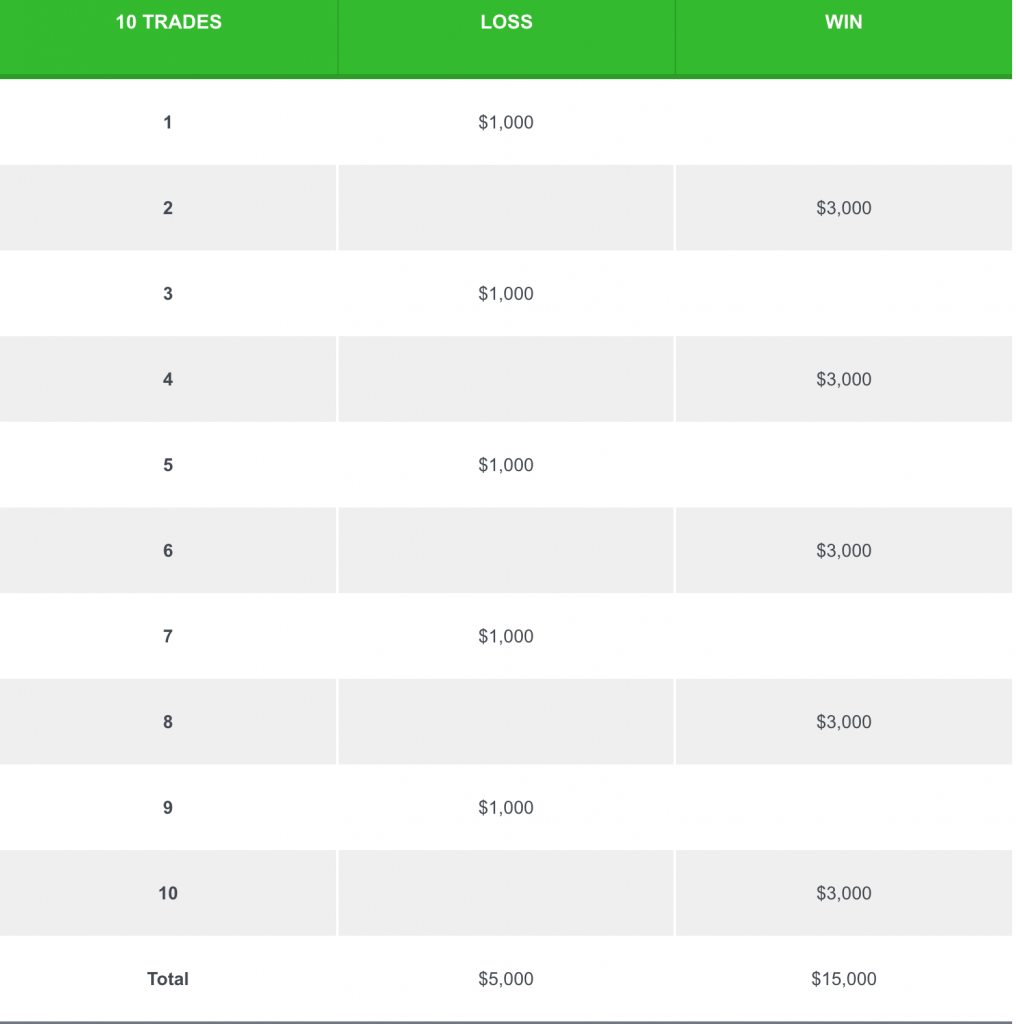

The goal of forex traders should always be to gain more in winning trades than you lose in losing trades.

A simple methodology, yet rarely executed (to be fair, forex trading is difficult!)

Many professionals recommend at least a 1:1 risk/reward ratio – this way, even if you’re wrong half of the time, you will still break even at the end of the day.

However, anything worse than a 1:1 risk/reward ratio is dangerous.

If you are risking $100 for the potential to make $50 on a single trade (a 2:1 risk/reward ratio) then you are setting yourself up for failure.

The better risk/reward ratio you choose to trade with, the fewer times you need to be right.

If you win half of the trades with a 1:2 risk/reward ratio, you still come out on top.

BabyPips recommends at least a 1:3 risk/reward ratio… it really all depends on who you’re talking to.

Source: BabyPips

It’s certainly worth mentioning that the risk/reward ratio is a highly discussed (and controversial) subject in the forex industry.

For example, many will say that it can be disregarded for other, more advanced equations.

If you are new to forex trading, make sure you know what you’re doing when it comes to managing your risk and reward.

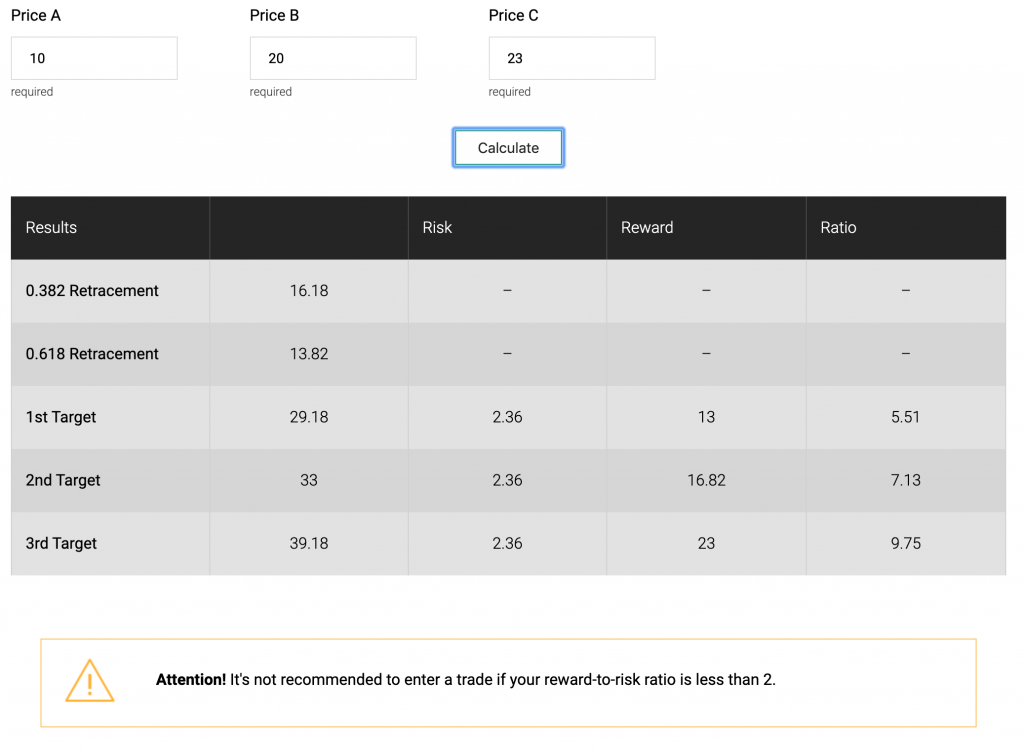

Forex Risk Reward Calculator

There are many calculators you can find that will do the risk/reward, reward/risk calculations for you and give you the ratio you can use to assess your trades.

A basic yet functional reward to risk calculator can be found on EarnForex.com by following this link.

It looks like this:

Simply enter the required inputs and it will calculate your risk to reward ratio in milliseconds.

How to Be Successful at Forex Trading

Using risk management and other effective money management strategies are great ways to help ensure your success in forex trading.

In addition, there are some other helpful tips to try and follow in your trading:

- Prepare yourself for what’s ahead.

- Know your time frames and which strategies you plan to use.

- Use a consistent methodology in trading.

- Test your instruments and currency pairs always.

- Stay up to date with economic news.

Final Words

The question of ‘Is Forex Worth It’ depends on the individual, and how much time and effort (and money) one is willing to put into learning how to trade forex.

If you ask me or my friends who trade for a living, yes, forex trading is worth it.

The answer to whether forex is worth it or not is entirely objective, and you must figure out how badly you want the ‘success’ and if you’re willing to put in the time to make it happen.

Learn to Trade Forex

If you are interested in learning how to trade forex and you want to know how you can make consistent profits, every single day, then it’s important to properly educate yourself.

For beginner forex traders who want to get on the path to financial stability, go check out our post on a forex mentorship program that offers an insane amount of value for those who want to learn how forex trading works.

Also, if you haven’t already, make sure to grab a copy of our Free Forex Trading Fortunes PDF.

[convertkit form=1499651]Is Forex Worth It?

Most people are not prepared to invest the money and time necessary to really understand forex trading and how profitable trades are made, however, if you are willing to invest time then Forex Trading can be very worth it.

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.