Table of Contents

What are PAMM Forex Accounts? What are MAM Forex Accounts? What is LAMM?

Another question often asked online is what PAMM, MAM, and LAMM is in forex. It’s important to note that these are not common terms you will come across if you’re a beginner in the forex world, however is useful to know for general knowledge.

PAMM and MAM accounts give forex fund managers the ability to manage multiple accounts from just one account, and prevents the need to create an investment fund.

To understand what PAMM forex accounts are, let me explain what PAMM actually stands for.

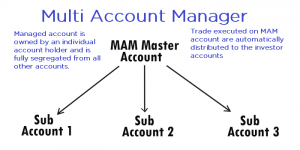

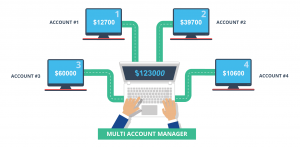

MAM, short for Multi Account Manager.

PAMM and MAM’s make it easy for forex fund managers to execute a trade and copy them into their trading accounts. Forex fund manager’s trade on behalf of their investors, while the investors oversee that their fund manager is increasing these funds by trading the markets.

Without PAMM or MAM, it would quite difficult for a forex fund manager to replicate their trades in real time. PAMM and MAM are modules in forex trading that allow access to advanced features for forex fund managers.

MAM and PAMM can be thought of as pooled money that goes into an account that the fund manager then trades with. The manager is an expert on forex trading and can be thought of as a safe investment for the people who give him money- they expect a return on investment.

Becoming a fund manager is difficult yet lucrative. There is no doubt that you will get rewarded for your talent to make lots of money through the forex markets, but as you can imagine it is very stressful. While it is an option for professional forex traders, few traders will ever actually take on the position.

Let’s take a look at the details of forex PAMM and MAM.

MAM Explained:

Multi Account Manager, also known as MAM, integrates as a plugin with the MetaTrade platform. By making use of MAM, the forex fund manager is able to copy their trades across different managed forex accounts with just one click. When a trade is executed on the master account, the MAM executes the same across all the managed accounts in real time. MAM offers great benefits for a forex fund manager, which also includes automatically deducting the fund manager’s fee for trading the managed accounts in forex.

There are different ways in which the quantity or the lot size is decided for each of the managed accounts when a trade is applied. LAMM and PAMM are commonly used aspects that determine the size of the lot and to which account it should be applied to.

LAMM Explained:

LAMM, short for Lot Allocation Management Module.

Under a lot allocation management module, or LAMM, a customer or a managed account is traded using the same lot size as the master account irrespective of the account size for the client’s forex account. LAMM is ideal when the managed accounts have the same size as that of the money manager. The problem arises when the size drop below the main trading account. This greatly increases the risks and makes use of higher leverage. Under the circumstances, making use of PAMM is more preferred.

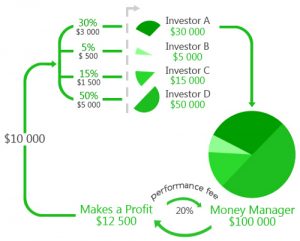

PAMM Explained:

PAMM, or Percent Allocation Management Module, addresses the issue posed by the LAMM. A PAMM distributes the profits and losses incurred by the main trading account across all the managed forex accounts. The amount of distribution is in the same proportion as the size of the managed account and does not consider the lot size used for the trade.

Consider this example: a the manager’s account size is $5000, and he manages two accounts, accounts ‘A’ and ‘B’, having a capital of $2,000 and $3,000 respectively. The combined amount in this PAMM portfolio is $10,000.

In terms of distribution, the manager’s account is at 50 percent, A at 20 percent and B at 30 percent. Based on this percent allocation ,the profits and losses are applied to the account accordingly. So when there is a profit of $1,000, the manager gets $500, A gets $200 and B gets $300.

Make sense?

The same holds true if there was a loss of $1,000. This is the simplest illustration of how Forex PAMM works.

What are the benefits of using a MAM and PAMM?

MAM and PAMM makes it easy for the forex money manager to focus on the core activity, which is trading. The MAM and PAMM modules provides the owners of the managed forex accounts access to their portfolio in real time as they can watch the trades being executed in a live environment. MAM module is used by the forex money managers and assists them to keep a track of their trades, investment, portfolio management and much more.

When opting for a PAMM account, investors are required to sign a power of attorney that allows the forex money managers to access the client’s funds and trade with them.

Learn To Trade Forex

PAMM, MAM, and LAMM are forex terms that novice traders won’t often hear upon starting. This is jargon typically reserved for higher level traders or those with lots of capital who are able to invest their money into a forex fund manager, with the aim of getting a return on their initial deposit.

If you are unfamiliar with these terms and want to learn more about what forex actually is, read our post about it here. It’s a brief overview of what forex is all about and how to get involved.

If you are a beginner and are interested in actually learning how to trade and how to make a nice living doing it, go here to read about a course that will teach you everything you need to know about forex trading.

Lastly, if you are new to trading and want a Free Forex Trading PDF to help teach you about market trends and patterns – get your copy sent straight to your email below.

[convertkit form=1499651]

I’m a full-time forex trader, happily making money from the comfort of my own home.

I help others find financial freedom and success with forex trading.